In the ever-evolving landscape of American politics, one name continues to resurface when discussions turn to aggressive economic nationalism and bold tax reforms—Peter Navarro. Often dubbed the “architect” of former President Donald Trump’s economic and trade strategy, Navarro has emerged once again as a central figure, this time driving a renewed push on Trump’s radical tax agenda. With the 2024 presidential race heating up, Navarro’s influence is shaping the narrative of economic self-sufficiency, tax aggression, and domestic production revival.

This article delves into the role of Peter Navarro in pushing Trump’s tax strategy, examining his philosophies, past accomplishments, policy impacts, and what his resurgence could mean for the future of U.S. tax policy.

**A Brief Background: Who Is Peter Navarro?**

Peter Navarro is an economist, author, and former White House adviser who became one of the most recognizable economic voices in Trump’s administration. Holding a Ph.D. from Harvard University, Navarro’s academic background initially focused on trade and macroeconomic policy. However, his notoriety grew during the Trump era as he championed protectionist policies and challenged globalist economic models.

He gained a reputation as a hardliner, particularly in trade conflicts with China, advocating for aggressive tariffs and reduced foreign dependence. Now, with Trump’s re-election ambitions clear, Navarro is once again in the spotlight—this time not just for trade policy but for reshaping the tax code.

**The Foundation of Navarro’s Economic Vision**

Navarro’s economic philosophy is rooted in what he terms “economic nationalism.” He views a strong domestic economy as essential for national security and sovereignty. This belief informs his stance on taxation: he sees tax policy as a tool to incentivize domestic manufacturing, penalize outsourcing, and strengthen America’s economic base.

Central to this vision is reducing corporate taxes for domestic businesses while increasing penalties for companies that outsource jobs or move operations abroad. Navarro also advocates for targeted tax incentives that promote industrial innovation and reduce dependency on foreign supply chains—especially in strategic sectors like semiconductors, energy, and pharmaceuticals.

**The Tax Agenda: Trump’s Weaponized Fiscal Strategy**

Navarro has been instrumental in developing and articulating Trump’s latest tax proposals, which diverge sharply from traditional conservative tax cuts. Rather than uniformly reducing taxes, Trump’s new tax plan—under Navarro’s guidance—aims to reshape corporate behavior through a system of rewards and punishments.

This approach includes:

– **Tax penalties for companies that offshore jobs**

– **Lower tax rates for companies that invest in American workers and infrastructure**

– **Eliminating loopholes that allow multinational corporations to shelter profits overseas**

– **“America First” tax credits for companies sourcing and producing within the U.S.**

Navarro’s plan positions taxation not just as a means of revenue generation but as a tactical weapon in the war for economic supremacy.

**Critics Sound the Alarm**

While Navarro’s strategy has earned praise from economic nationalists and protectionist thinkers, it has also drawn heavy criticism. Many economists argue that using tax policy to micromanage corporate decisions can backfire, leading to inefficiencies and reduced global competitiveness. Critics also point out that such tax reforms could invite retaliatory measures from international trade partners, potentially sparking tax wars and increased tensions.

Moreover, some in the business community worry that punitive taxes on outsourcing could harm U.S.-based multinational firms and reduce their global agility. The fear is that over-regulating through tax measures may discourage innovation and investment.

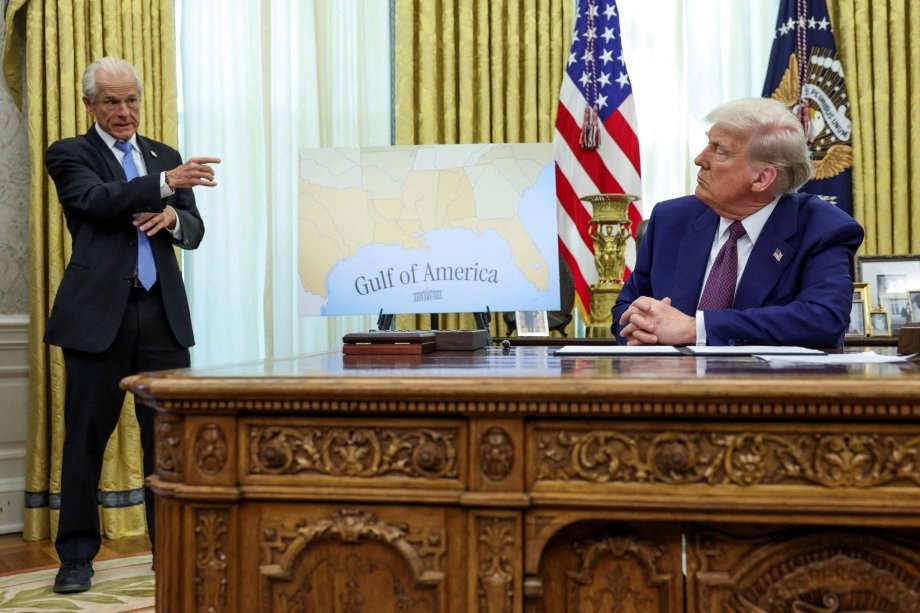

**The Trump-Navarro Dynamic: A Powerful Partnership**

Few figures have had as much influence over Trump’s economic messaging as Peter Navarro. Their working relationship is defined by a shared skepticism of globalization and a belief in American self-reliance. Navarro’s ability to simplify complex economic issues into digestible, campaign-ready language has made him a valuable asset in Trump’s inner circle.

Trump often refers to Navarro’s proposals in campaign speeches, framing them as common-sense solutions to economic decline. Whether discussing the loss of manufacturing jobs or the rise of China’s economic power, Navarro’s fingerprints are all over Trump’s policy rhetoric.

**Impact on the Republican Party’s Economic Platform**

The Republican Party has traditionally been the party of free markets and low taxes. However, with the rise of Trumpism and Navarro’s influence, there is a noticeable shift toward interventionist economic policies. This ideological evolution is creating a rift within the party.

Establishment Republicans continue to promote deregulation and market-driven policies, while the Trump-Navarro faction advocates for a more hands-on approach that uses the tax code to mold corporate behavior. This divergence may define the party’s future economic identity and influence how it governs should Trump return to power.

**Navarro’s Trade-Tax Nexus: A Unified Economic Doctrine**

Peter Navarro does not view trade and taxation as separate policy arenas. Instead, he envisions them as complementary tools in building economic strength. For example, tariffs on foreign goods combined with tax credits for domestic production form a unified strategy to drive manufacturing back to American soil.

This holistic approach reflects Navarro’s broader goal: reducing economic interdependence and fostering national resilience. Whether through taxing outsourced goods or rewarding domestic job creation, Navarro’s framework promotes a closed-loop economic model centered on national interests.

**The Middle-Class Appeal: Political Capital in Economic Populism**

One of the key political advantages of Navarro’s tax plan is its appeal to the middle class. By portraying multinational corporations as the villains and American workers as victims of globalization, Navarro taps into populist anger. His tax plan offers a solution: punish the corporations, reward the people.

Tax cuts for small businesses, credits for companies that offer apprenticeships, and penalties for offshoring resonate with working-class voters. This messaging is potent, especially in swing states that have been devastated by deindustrialization.

**What a Navarro-Inspired Tax Code Could Look Like**

If Trump returns to office with Navarro at his side, the U.S. tax code could undergo dramatic changes. Key features of a Navarro-style tax regime might include:

– A dual corporate tax structure: lower rates for domestic production, higher for global operations.

– Revamped capital gains taxes tied to domestic reinvestment.

– New taxes on intellectual property profits earned abroad.

– Strict enforcement against offshore tax shelters.

– National manufacturing tax credits tied to job creation metrics.

Such a system would radically shift incentives, making it more profitable to build and hire in America than abroad.

**Legal and Constitutional Challenges Ahead**

Implementing such sweeping tax reforms will undoubtedly face legal hurdles. Critics argue that some of Navarro’s proposals may violate international tax treaties or exceed federal authority. Legal scholars also raise questions about targeting companies based on global operations, which could trigger constitutional disputes over equal protection and commerce clauses.

Nevertheless, Navarro has expressed confidence that the urgency of economic recovery and national resilience will override traditional legal interpretations.

**Looking Forward: Is Navarro the Future or a Relic?**

Peter Navarro’s return to the political spotlight underscores a broader transformation in how America debates economic policy. His ideas challenge decades of economic orthodoxy, offering an alternative vision rooted in nationalism and industrial self-sufficiency.

Whether his proposals become law or simply fuel campaign rhetoric, Navarro’s influence is undeniable. As Trump rallies support for a political comeback, Navarro’s tax agenda will remain a cornerstone of the economic narrative—one that reshapes how Americans think about wealth, work, and national priorities.

**Conclusion: The Strategist Who Redefined Economic Warfare**

Peter Navarro has emerged not just as a policy adviser, but as a strategist redefining economic warfare. His efforts to weaponize tax policy for national gain mark a significant departure from the post-Reagan economic consensus. While critics call his ideas risky and extreme, supporters hail them as visionary and necessary.

As the 2024 election approaches, one thing is certain: Navarro’s blueprint for tax reform will be one of the most debated—and potentially transformative—policy issues in the country. Whether history views him as a savior or a saboteur may depend on the outcomes his ideas produce, but his role as the “architect” behind Trump’s tax attack is already cemented.